tax avoidance vs tax evasion hmrc

Avoiding tax is legal but it is easy for the former to become the latter. Other ways to report.

Tax Evasion Hmrc New Investigation Powers

Discover more about tax avoidance and evasion.

. From 2018 to 2019 HMRC secured a record 341 billion in additional tax through activity tackling tax avoidance evasion and non-compliance. Schemes it is likely that HMRC will uncover companies whove claimed what they shouldnt. In fact it was announced in the Spring.

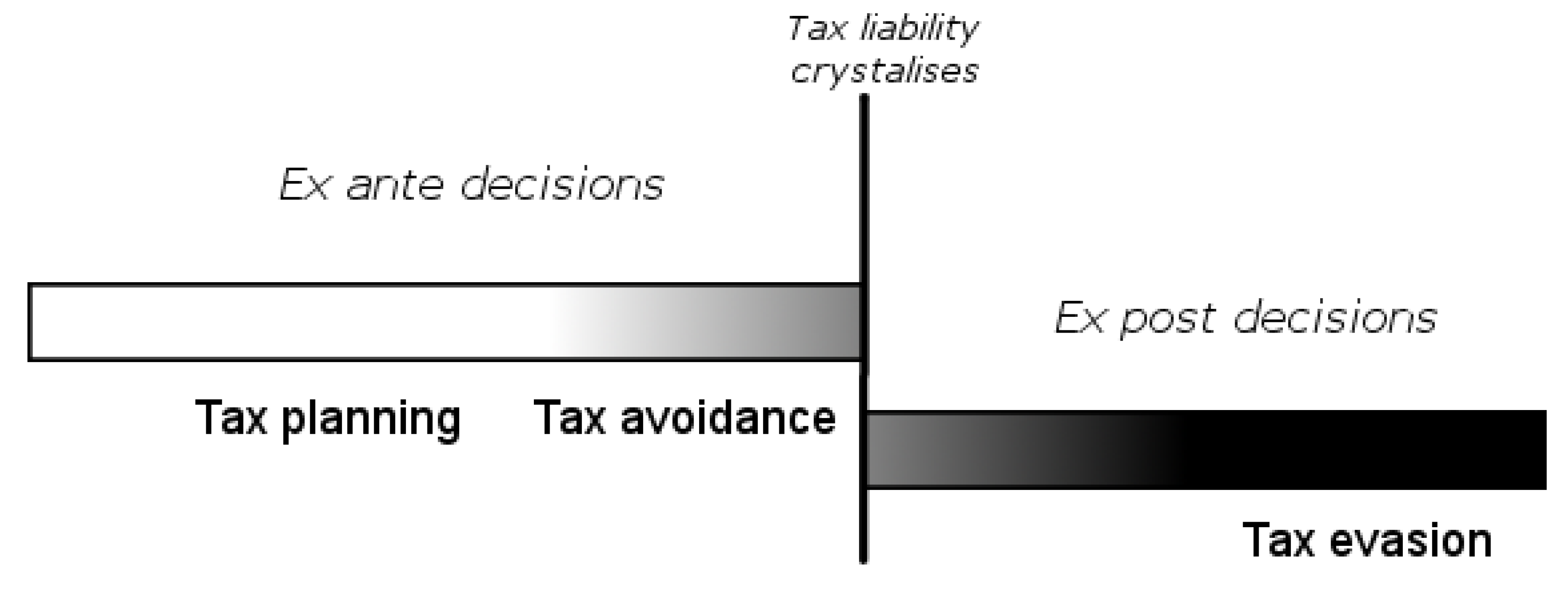

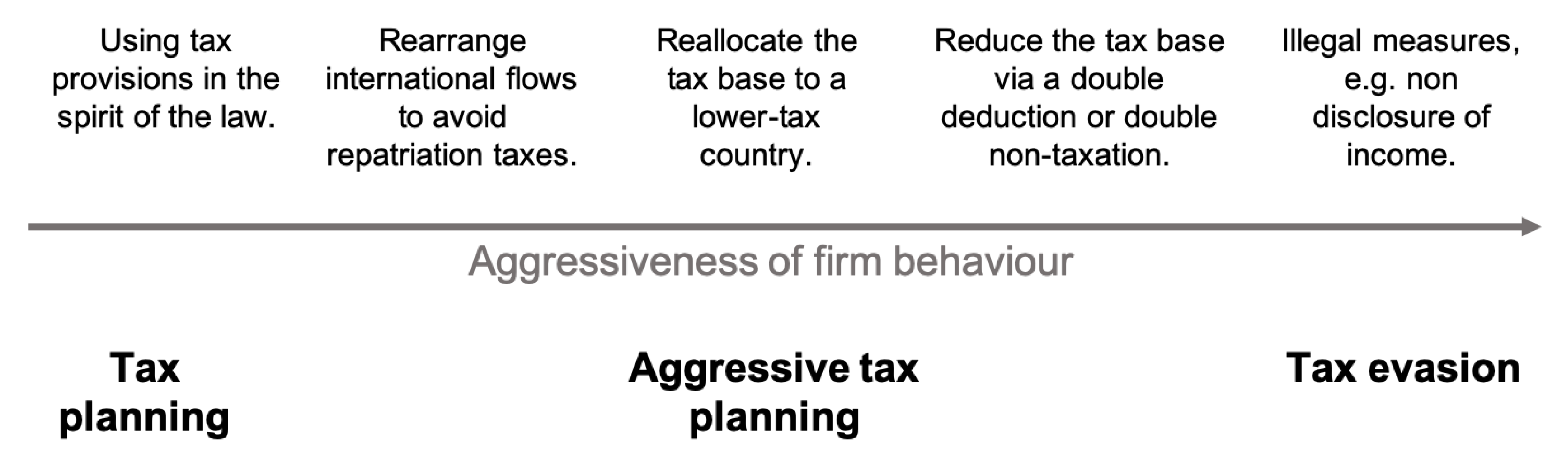

The tax evasion vs tax avoidance debate is a long-standing one. DAC6 is a European regulation. Tax planning either reduces it or does not increase your tax.

With recent gov. On 16 Feb 2022. Monday to Friday 9am to 5pm.

Tax evasion on the other hand is using illegal means to avoid paying taxes. A tax avoidance scheme is an artificial arrangement to avoid paying the tax. Tax Gap Tax Avoidance and Tax Evasion.

The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. In the same period tax. Contact the HMRC fraud hotline if you cannot use the online service.

Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax. Tax evasion is an illegal activity that involves lying to the IRS or another taxing authority about the amount you owe. 44 203 080 0871.

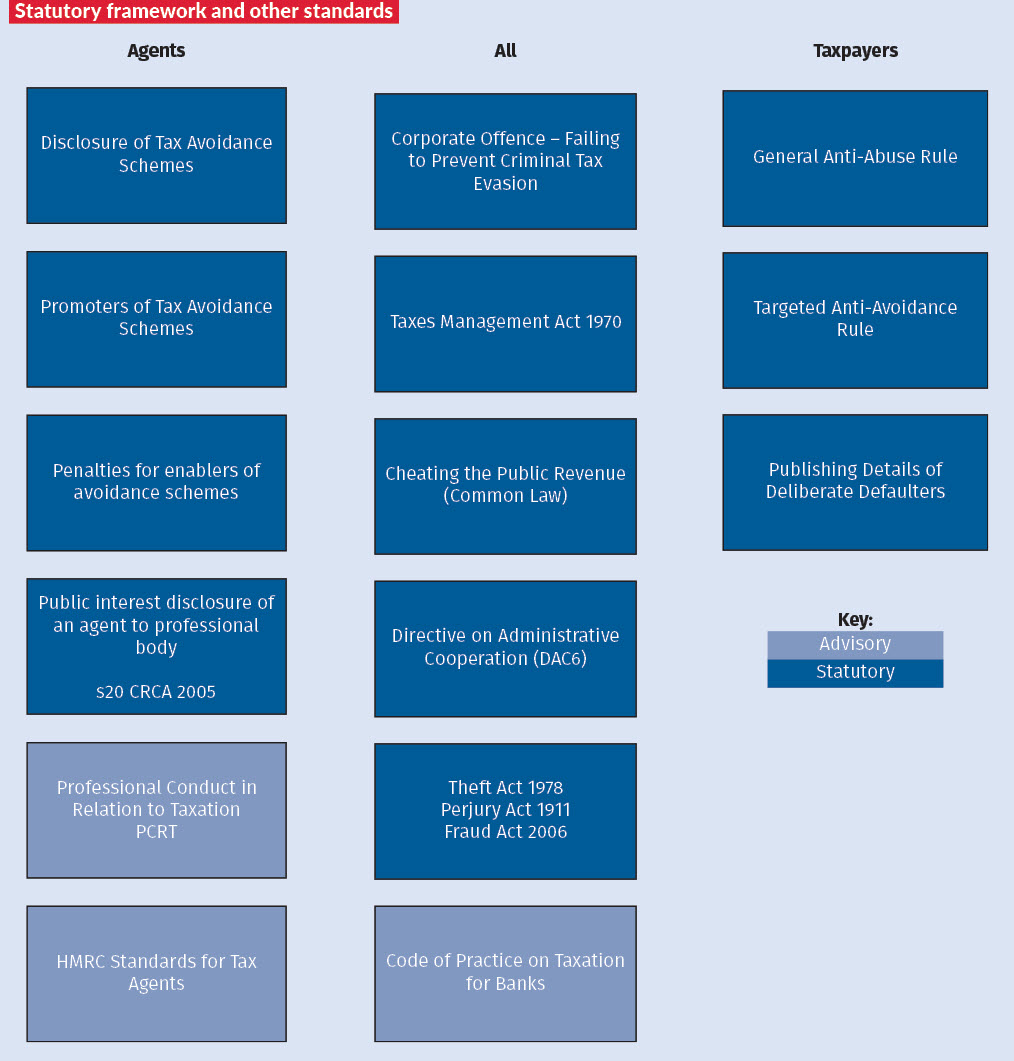

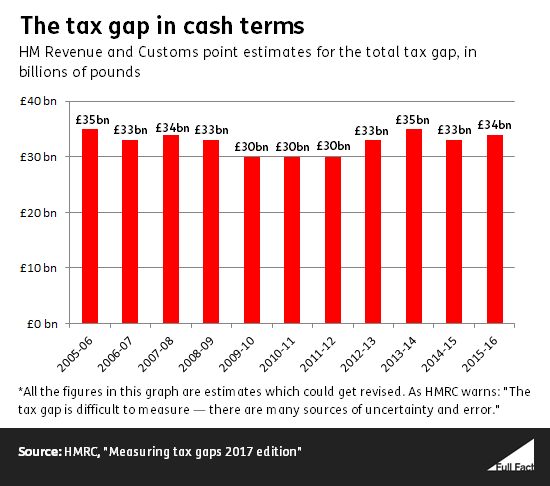

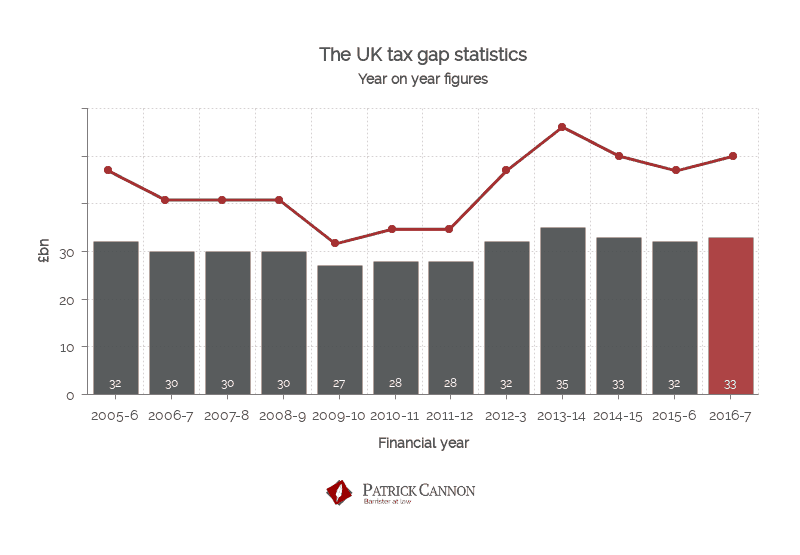

In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B. HMRC define the tax gap as the difference between the amount of tax that they should be collecting and the amount they actually collect. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities.

The difference between tax avoidance and tax evasion essentially comes down to legality. The difference between tax avoidance and tax evasion is. It is estimated that in 201920.

This is much easier to define as to have. The Norwegian context is attractive to study the interplay between tax avoidance and tax evasion for several reasons. It can involve misrepresenting your income purposefully inflating your.

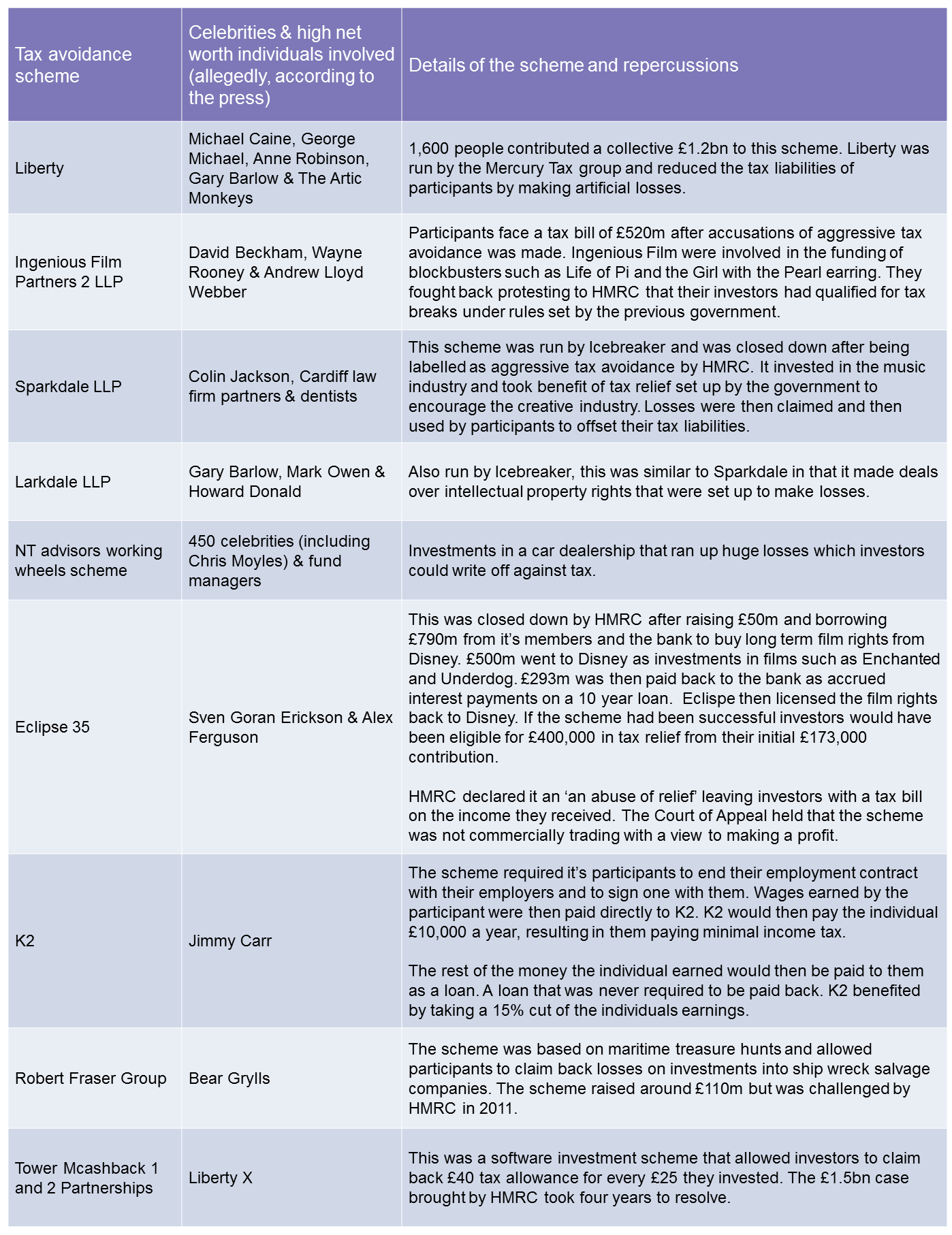

Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down. Tax avoidance vs Tax evasion-Understanding the difference between both and having an accountant that knows the complexities of the UK tax system is really important. This might be underreporting income inflating deductions without proof hiding or not reporting cash transactions or hiding money in offshore accounts.

Tax evasion and avoidance schemes are designed to reduce peoples tax bills and are both viewed negatively by HMRC. For example getting taxable income as loans or other payments youre not expected to pay back. Usually tax evasion involves hiding or misrepresenting income.

Unsurprisingly this is an area where HMRC are making great strides with many new measures being introduced to help crackdown on tax evasion. First the enforcement policy represents an exogenous. Only GBP600 million related to schemes marketed to individuals mostly made up of avoidance of income tax national insurance contributions and capital gains tax.

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Calls To The Hmrc Tax Avoidance Hotline Have Gone Up

Hmrc Urges Customers To Leave Tax Avoidance Scheme Promoted By London Based Firm Payadvice Uk

What S The Difference Between Tax Avoidance And Evasion Is Tax Avoidance Legal And How Do The Schemes Work The Sun

Understanding Tax Avoidance And Tax Evasion Youtube

Tax Evasion How To Get To The Top

9 Exposed Celebrity Invested Tax Avoidance Schemes

Measures Available To Hmrc To Tackle Avoidance And Evasion Taxation

Received A Letter From Hmrc Saying You Might Be Involved In Tax Avoidance And Don T Know What It Means In This Article We Help You Understand It Low Incomes Tax Reform

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Evasion Uk Hi Res Stock Photography And Images Alamy

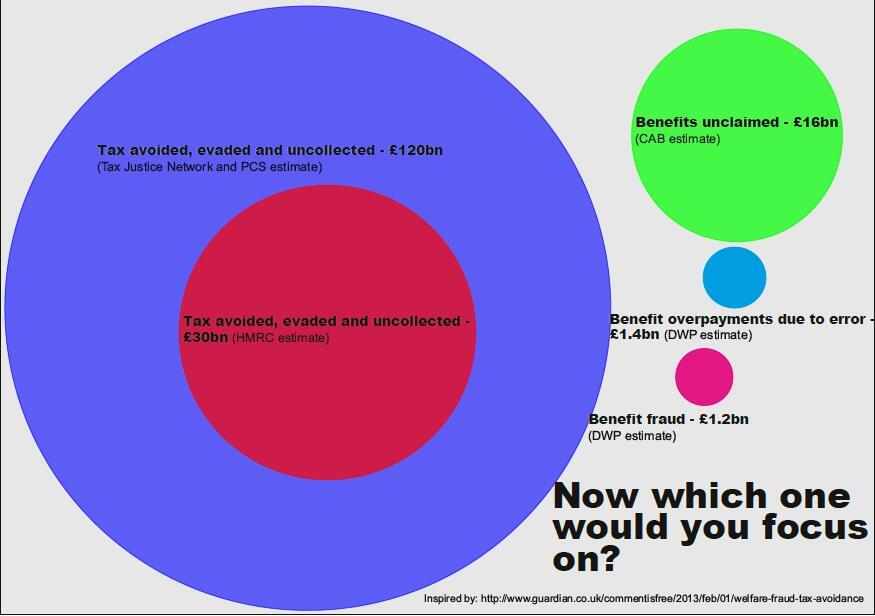

Simon Griffiths On Twitter Cost Of Tax Avoidance Evasion Vs Benefits Fraud Https T Co Mm8efwb3ot Via Newsframes Twitter

Hmrc Task Forces Crank Up Battle Against Tax Evaders Financial Times

Tax Dodging How Big Is The Problem Full Fact

Uk Tax Evasion Crackdown Expected To Net 2 2bn Financial Times

Exclusive Brits Slapped With 571m In Hmrc Fines In Crackdown On Tax Avoidance And Late Payments

Tax Evasion Questions Lecture 9 If You Need Quesions To Give You Focus Feel Free To Answer Studocu

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon